The smart Trick of Increasing Term Life Insurance - Resources - eFinancial That Nobody is Discussing

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)

What Is Term Life Insurance? - RamseySolutions.com

4 Simple Techniques For Term Life Insurance - What Is It & How Does It Work? - AIG Direct

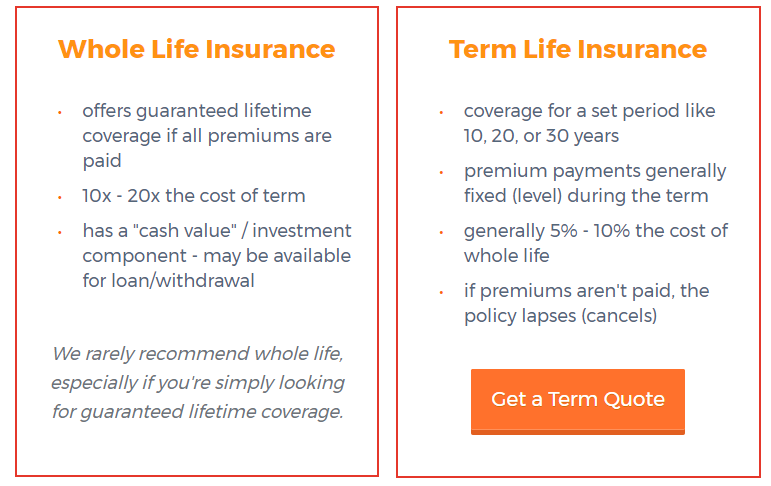

guaranteed level premiums and a guaranteed death advantage. This essentially indicates your premium and death benefit amount will stay the very same throughout. Benefits and drawbacks of entire life insurance coverage: Entire life insurance coverage does not have an expiry date, provided you pay the premiums on time.: Whole life insurance policies include a savings account.: A few of these policies offer you an opportunity to make annual dividends. Whole life premiums can cost 5 to 15 times more than similar term life policies.: Entire life insurance coverage is more complicated than term life. That's because it is a combination of two financial parts life insurance coverage and investment.: You have no control over how the insurance company invests your cash value.: Fees for whole life financial investments can surpass 3%.

Understanding Group Term Life Insurance

The Definition of Term InsuranceTerm is limited time life insurance Insurance usua… - Life insurance quotes, Permanent life insurance, Universal life insurance

I: You may need to pay a high cancellation fee if you end the policy within a few years. As a guideline of thumb, whole life insurance is more expensive than term life. More Details 's because it provides lifelong protection and builds up money worth. Lifelong coverage, No, Yes, Choice of term length

, Yes, No, Low premiums, Yes, No, Level premiums, Yes, Yes, Level death benefit quantity, Yes, Yes, Constructs money worth, No, Yes, Possible to make dividends, No, Yes, This ought to give a clear concept on the functions that feature each policy. Term life is more budget friendly due to the fact that it comes with an expiration date and doesn't construct money worth.